Here to Simplify the "1031 Exchange" for You and Your Clients

Get notified when your listing qualifies with the

plugin

plugin Use our marketing tools to attract new listings

Get Notified When Your Listing Qualifies with the dotloop Plugin

Rather than make Agents come to seminars, or read educational materials, we created a Dotloop plug-in to help Agents learn in real-time, and to bring up 1031 as an option only when applicable.

1031 Exchanges don’t come up on every sale, but they come up a lot more than you’d think - roughly 1 in 4 residential homes sold each year could qualify!

Forward a $200 Gift Card to Your Client

$458,500*

Adjust to show potential tax savings

Show Your Client the tax-problem, and the solution

The Tax-Slider on SellTaxFree.com was designed to make it easy for you to show your clients how big their tax-problem could be, and how a 1031 exchange can help solve it!

Market with a “Sell Tax Free” Message

Engage New Clients with the "Sell Tax Free"

Even if a Prospect responds, but doesn't exchange,

It's still a great listing lead!If anyone engages with the tools, or your ads, you will be notified, and it will be tracked in your Marketing Report (

Click Here to see a sample).How to talk about the tax problem

Use the videos to the left to learn how to talk about different 1031 scenarios when Clients engage with 1031 messaging, or the Dotloop notification program.

You can also Download the Scripts in PDF format.

Download PDF

A Gift for Our Partner Agents

Do you own your own investment property? As a partner-Agent, we'd like to offer you a FREE 1031 Exchange ($795 Value), on us. To register, just sign up below!

Agent FAQ's

- Use a Qualified Intermediary/Accommodator (like SellTaxFree.com /1031 Exchange Advantage) to set up their exchange paperwork.

- Set up their exchange before they close on their sale.

- Reinvest all of the cash they'll net from their sale (after paying off mortgages, commissions, closing fees, etc.) into new investment property of equal or greater value. If you only partially reinvest you'll pay some tax and avoid some.

Lots of properties qualify! Just to name a few:

Is a Qualified Intermediary, 1031 Accommodator, or 1031 Exchange firm required? Can I use my escrow?

The IRS requires that investors use a Qualified Intermediary/Accommodator (like SellTaxFree.comTM / 1031 Exchange Advantage®) when doing a 1031 exchange.

Since a Qualified Intermediary/Accommodator is required to hold the sale proceeds ($), security of client-funds should be the highest priority; SellTaxFree.comTM has built industry-leading security protocols for securing client funds.

- An exchange must be set up BEFORE the sale is closed.

- An exchange begins on the closing date of the sale.

- Replacement properties must be identified within 45 Days of the closing date of the sale.

- Replacement properties must be purchased within 180 Days of the closing date of the sale.

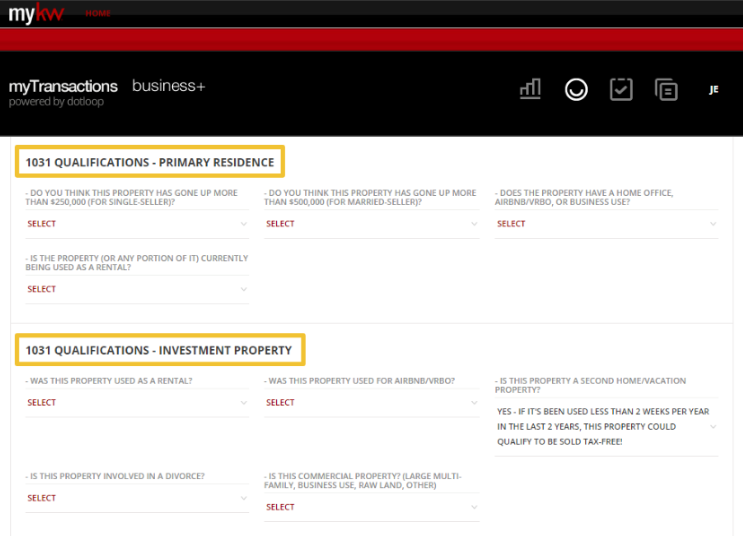

If we're partnered with your brokerage office, you'll see the following '1031 Qualification Questions' any time you upload a listing in Dotloop:

If any of the questions are answered "Yes," you will get:

- Alerting you that your client's property may qualify to be sold tax free - giving you the opportunity to save them thousands

- A Phone Call Follow-Up Notification

- A link to schedule a FREE Attorney* Consultation

- A $200 Gift Card (for a Standard Exchange)

An Email Notification

If none of the questions are answered "Yes," then a 1031 exchange does not apply to your listing.

A 1031 Exchange requires a sale and a purchase:

- Agents can get another listing by becoming the Buyer's Agent for their Seller, or

- A referral commission from referring their client to another agent.

Also, by bringing up a 1031 exchange, Agents can save their clients tens, or even hundreds of thousands of dollars in unnecessary taxes! That means referrals, and some serious Agent-appreciation from that Client. The Agent also establishes their real estate expertise by bringing up 1031 when it's applicable.

- We offer FREE Attorney Consultations on every exchange.

- In over 35 years of operation we have Never Had a Claim for (a) misappropriation of client funds, or (b) wire fraud due to our Industry-Leading Security Protocols, and Patent Pending Wire-Fraud-Reduction Process. Learn more at www.SellTaxFree.com/Secure-Exchange.

- We have the Lowest Fees in the Industry for Standard, Reverse, and Improvement Exchanges. * If you find other firms offering a cheaper price, let us know and we'll almost always match it!

Problem: Great Agents are eager to help their clients, but great Agents are extremely busy. Lots of properties can be sold tax free with 1031, but most Agents and their clients are unaware of which properties qualify, or simply forget to bring up 1031, costing Clients thousands in unnecessary taxes.

Solution: The SellTaxFree.comTM 'Heads Up' Program gives Agents the ability to spot tax-saving opportunities for their Clients every time they're available. And by bringing up a 1031 exchange, and Agent could save their client hundreds of thousands of dollars.

* Attorney or trained mentor